Topics

How to Enter Information on Children?

How is Tax Exemption on Children Education Allowance Calculated?

Proof Submission for Claiming Exemption on Children Education Allowance

How to Enter Information on Children?

Please note that exemption on Children Education Allowance can be claimed only if your employer pays you children education allowance. In the event of your not receiving children education allowance from your organization, you will not be able to view the screen to enter your declaration for claiming the exemption.

In case your organization offers children education allowance as part of salary to you and you do not specify the number of children in Tanqaa, the amount you receive as children education allowance will be fully taxed.

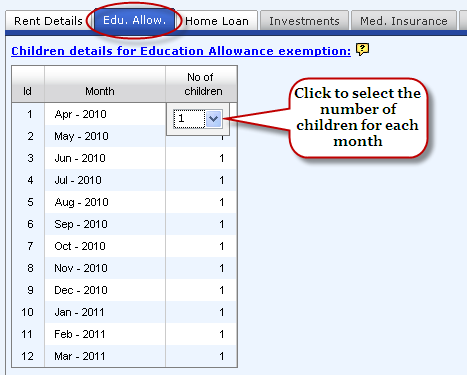

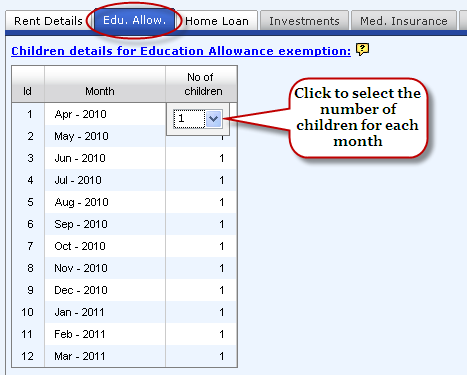

In the table titled "Children details for Education Allowance exemption", you will see a table in which you can specify the number of children for each month in the financial year.

Field |

Instruction |

Month |

The month and the year appear in the read-only mode. |

No of children |

Please click the field and select the number of children for which you wish to claim exemption, for each month of the year. You can enter a maximum of 2 children each month from the drop down. As soon as you select the number of children for a month, the same number is applied for the remaining months in the year, for your convenience. You choose to change the number for any of the months. |

How is Tax Exemption on Children Education Allowance Calculated?

The tax law allows an exemption of Rs. 100 per month per child up to a maximum of two children .

Proof Submission for Claiming Exemption on Children Education Allowance

You are not required to submit any proof for claiming exemption on children education allowance.

Copyright , Tandem Integrated Business Solutions Private Limited