Topics

How to Enter Maintenance Expenditure for a Disabled Dependant?

How Does Maintenance Expenditure for a Disabled Dependant Reduce Your Tax?

Proof Submission for for Maintenance Expenditure for a Disabled Dependant

How to Enter Maintenance Expenditure for a Disabled Dependant?

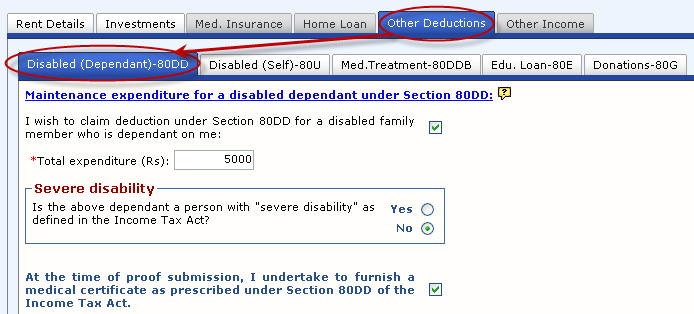

To claim deduction under section 80DD for a disabled family member who is a dependant, please click the checkbox, under the title "Maintenance expenditure for a disabled dependent under section 80DD."

You can enter the total amount (in Rs) for the year. The amount can have a maximum of two decimal places. Please scroll through the respective cells to update the details and click on the ![]() icon on this screen for help.

icon on this screen for help.

If the disease -- expenditure on treatment for which an exemption is claimed -- is a "severe" disability according to the Indian tax law, then select the check box below the table. Once you click the checkbox, you will see an option "Severe disability." Please click the appropriate option -- "Yes" or "No."

How Does Maintenance expenditure for a Disabled Dependant Reduce Your Tax?

Proof Submission for Maintenance Expenditure for a Disabled Dependant

The details of the required proof and guidelines are given below for your ready reference.

Section 80DD |

Proof to be submitted |

Guidelines |

Deduction for Medical Treatment of a Dependent with Disability |

Photocopy of certificate** issued by the competent medical authority in a Government Hospital, with a self-declaration, certifying amount spent on treatment |

Where the condition of disability requires reassessment, a fresh certificate is to be obtained after its expiry, to continue claiming the deduction |

**Please click here to download the prescribed format for the medical certificate.

Copyright , Tandem Integrated Business Solutions Private Limited