Topics

How to Enter Investment Information?

How do Your Investments Impact Tax Calculation?

What are Investments?

Under the "Investments" tab, you can enter information on the following.

1. Insurance policies

2. National Savings Certificates, Notified bank deposits, Public provident fund and other avenues

3. Principal amount repaid in your housing loan

4. Pension Fund

How to Enter Investment Information?

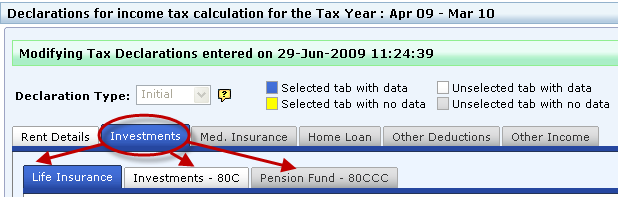

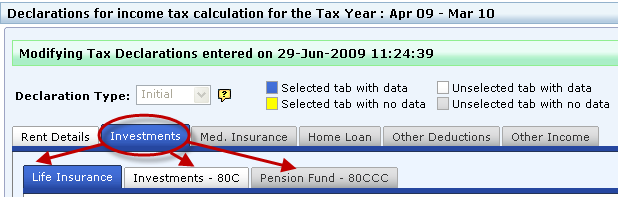

Please click on "Investments" tab, which facilitates you to submit declarations under Life Insurance Premium, Investments under section 80C and under Pension Fund under section 80CCC.

The sections referred to above are those that are specified by the Indian income tax law.

You can select the respective tabs to update details of the investments made. If you do not wish to enter information, you can choose to ignore this section.

How do Your Investments Impact Tax Calculation?

Your investments allow you to get a tax reduction under the so-called "Deductions under Chapter VI-A" of the Income Tax Act. An employee will be entitled to deductions for the whole of amounts paid or deposited in the current financial year, subject to a limit of Rs. 1,50,000 (1.5 Lakhs) under section 80C. Please note that there are no sub-limits under any of these investments. Therefore you can even claim tax rebate for the entire amount under any of the investments options. In addition, investments under Section 80C and under 80CCC (Pension fund) should be added while considering the Rs. 1,50,000 (1.5 Lakhs) limit.

Copyright , Tandem Integrated Business Solutions Private Limited